Implementing a sugar tax in South Africa

Why should South Africa welcome a sugar tax?

Professor Karen Hofman explains how a sugary beverage tax could reduce diabetes and obesity in South Africa in her recent lecture at Imperial College London.

As part of a Global Health & Development lecture, Professor Karen Hofman discussed the research evidence that informed the tax on sugary beverages in South Africa, to be promulgated in 2017/2018; and the political economy of potentially introducing such a levy.

A growing body of evidence indicates that excessive sugar consumption is driving epidemics of obesity and related non-communicable diseases (NCDs) around the world. South Africa (SA), a major consumer of sugar, is the most obese country in Sub Saharan Africa, and 40% of all deaths in the country are NCD related. Several fiscal, regulatory, and legislative levers could reduce sugar consumption in SA. These low cost instruments are a “Best Buy” and could save lives from obesity related diseases, save health care costs and generate revenue. This talk will focus on a sugar sweetened beverage (SSB) tax first proposed by the SA Treasury in 2016. Professor Hofman presented some of the analysis that informed key SA policymakers, the cost of inaction and discussed lessons learned from other middle income settings.

This event was chaired by Professor Franco Sassi, Professor of International Health Policy and Economics.

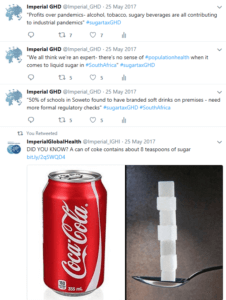

Here’s some of our Twitter highlights from Professor Hofman’s lecture…